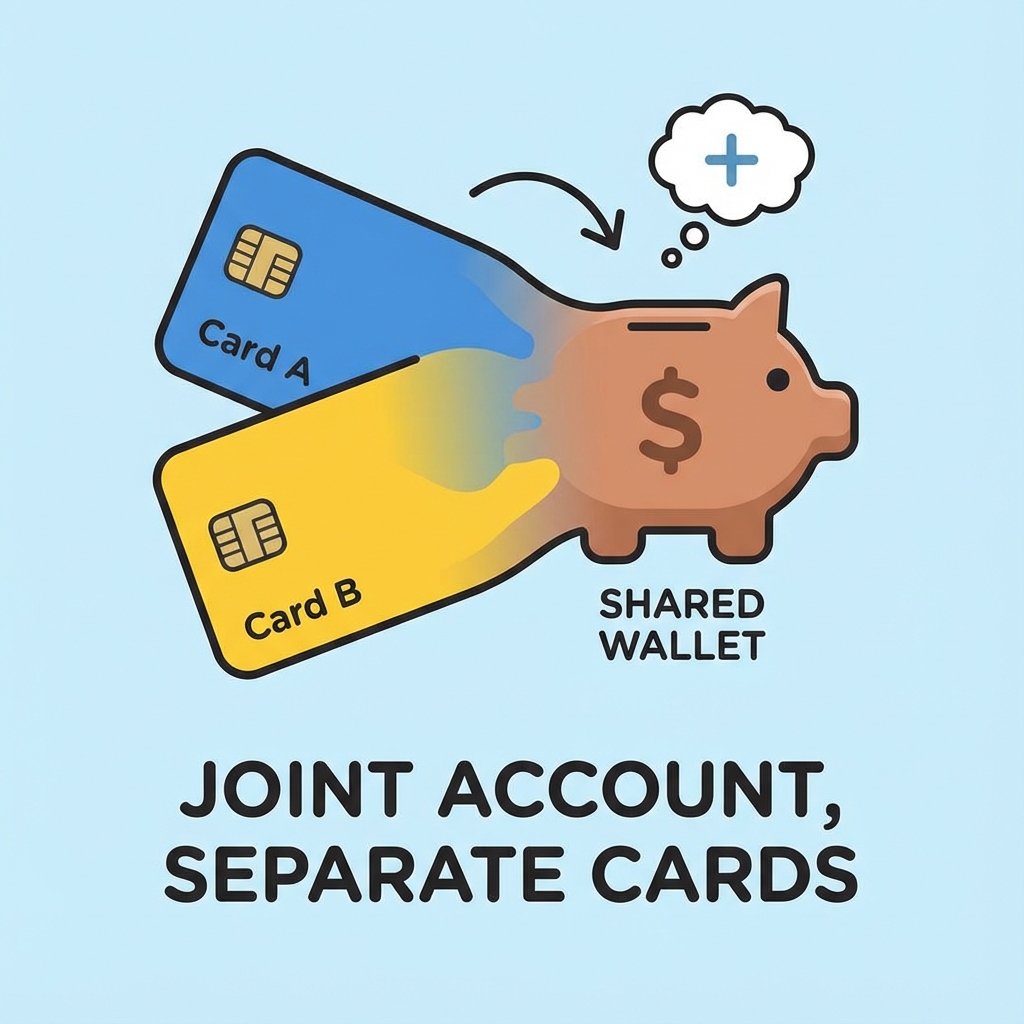

The Best Joint Bank Account with Separate Cards in Canada

Stop sharing a single debit card. Discover why KOHO's Joint Account is the best solution for couples who want separate cards but shared finances.

If you have ever tried to set up a joint account at a traditional bank, you know the pain. You both have to take time off work, go to a branch, sign a mountain of paperwork, and then wait 2 weeks for your cards to arrive.

And the worst part? Often, the user experience is clunky. You might share a single login, or struggle to see who spent what.

In 2026, couples demand better. They want autonomy and togetherness. They want separate cards for a shared balance.

Turn your spending into savings and get a $65 value bonus. Use code C4MNILZARC. Claim your savings bonus →

The “Two Cards, One Balance” Solution

KOHO’s Joint Account is engineered for modern relationships.

- The Setup: You invite your partner (or roommate) via the app. They accept. Done. No branch visits.

- The Cards: You EACH get your own physical and virtual Mastercard.

- One for you (with your name).

- One for them (with their name).

- The Balance: Both cards pull from the same “Joint” pool of money.

Why This is a Game Changer

1. Autonomy

You don’t have to pass a single debit card back and forth. You can be at the grocery store while your partner is at the gas station, and both transactions work seamlessly.

2. Transparency

Every time a purchase is made, both of you get an instant notification.

- “Partner spent $50 at Loblaws”

- “You spent $20 at Shell”

This eliminates the “did you pay the bill?” mystery. You can see your finances in real-time.

3. Shared Goals

You can set up shared Savings Goals within the joint account. Saving for a wedding or a vacation? Both of you can contribute, and you can track your progress together.

Perfect for Any “Joint” Situation

It’s not just for married couples.

- Common-law partners: Manage household bills easily.

- Roommates: Pool money for rent and internet.

- Parent/Child: Manage an allowance or student budget.

Conclusion

Banking shouldn’t be a burden on your relationship. With KOHO’s Joint Account, you get the convenience of separate cards with the power of shared finances. It is the smartest way to manage money together.

Learn more: App to Split Bills with Roommates and KOHO for Families.

👥 Bank Together, Smarter

Separate cards, shared balance. Use KOHO referral code C4MNILZARC to get up to $65 in sign up bonus value.